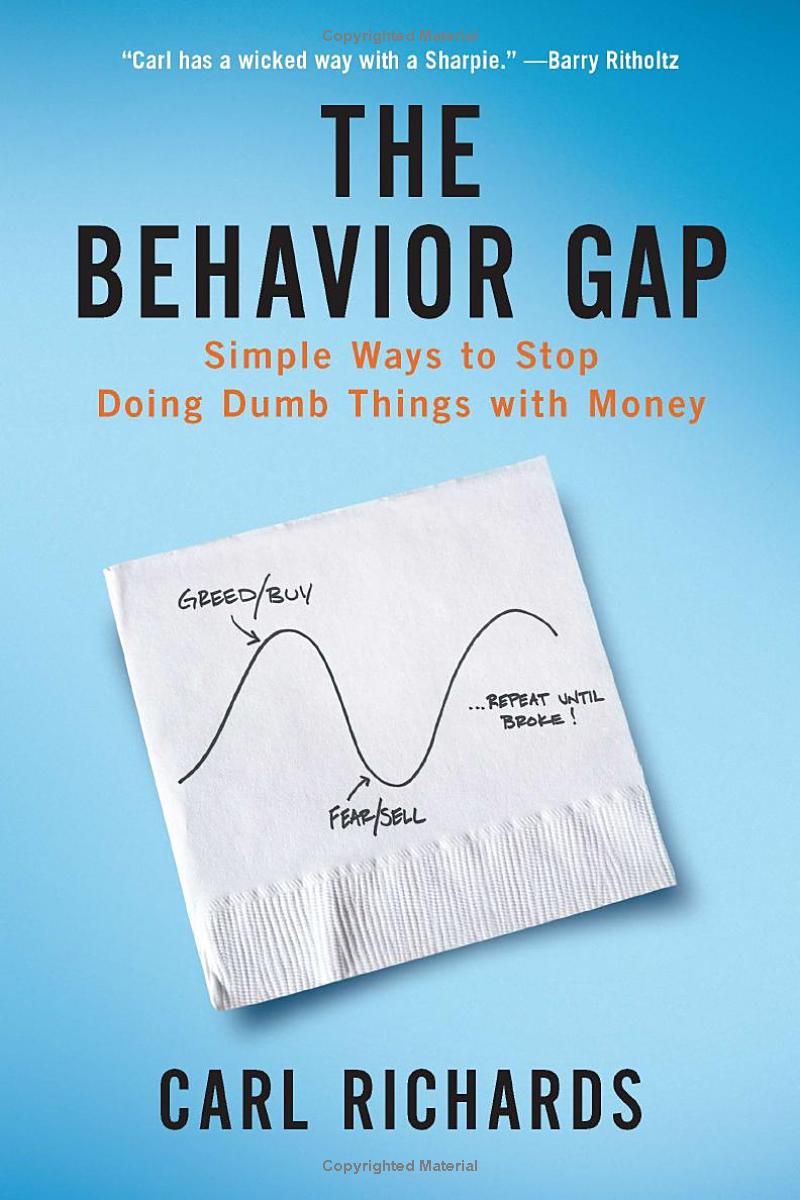

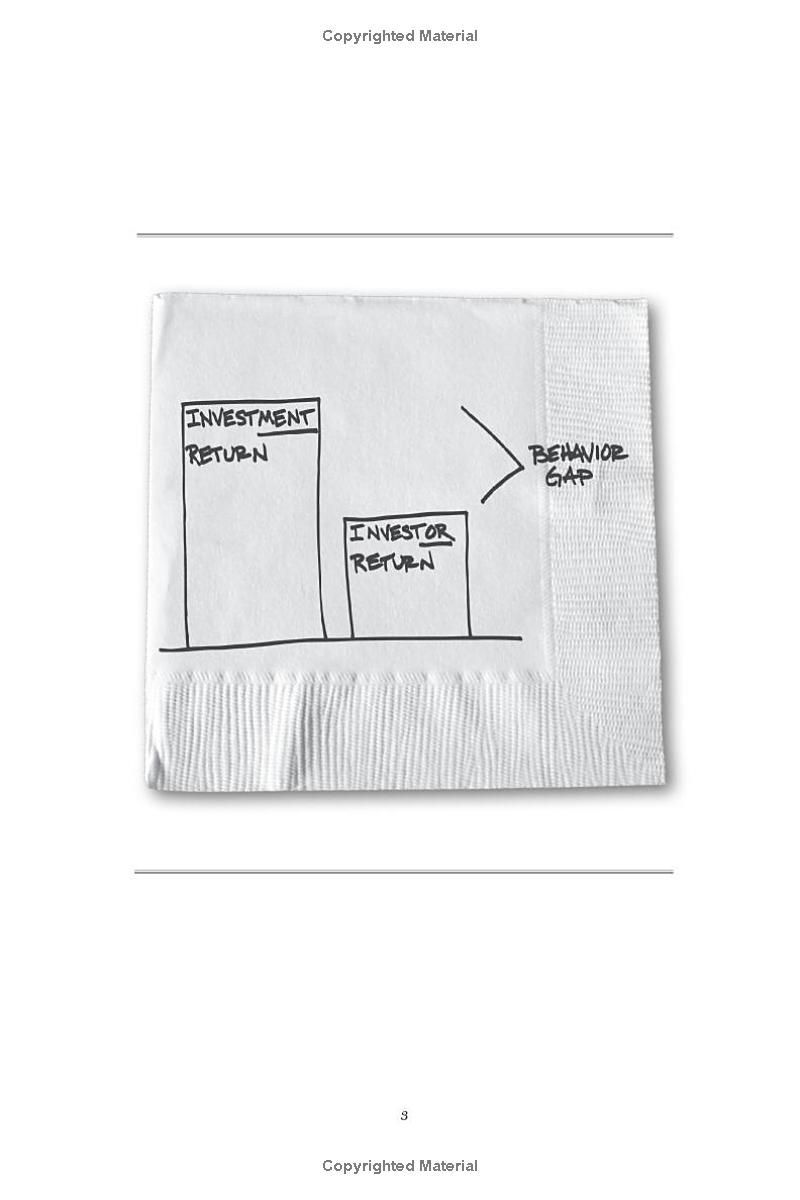

In The Behavior Gap, financial planner Carl Richards tackles the common pitfalls of personal finance, revealing that our emotional responses, not market fluctuations, are often the biggest obstacle to financial success. Richards identifies the "behavior gap"—the disconnect between what we should do and what we actually do—and its detrimental impact on our investments and overall well-being. Through insightful storytelling and simple illustrations, he helps readers understand their emotional biases, avoid common mistakes like buying high and selling low, and make more rational financial decisions. This book offers practical strategies for simplifying your finances, setting meaningful goals, and ultimately, achieving greater financial peace of mind.

Review The Behavior Gap

"The Behavior Gap: Simple Ways to Stop Doing Dumb Things with Money" by Carl Richards resonated with me on a deeply personal level. It's not your typical, dry financial advice book; instead, it's a conversational and insightful exploration of the psychological hurdles we all face when it comes to managing our money. Richards masterfully blends relatable anecdotes, clever illustrations, and straightforward advice, making even the most complex financial concepts easily digestible.

What struck me most was the book's honest and empathetic approach. It acknowledges that we're not inherently bad with money; rather, our emotions—fear, greed, the desire for instant gratification—often cloud our judgment, leading us to make irrational financial decisions. The author doesn't shy away from the fact that we all make mistakes, and that's okay. The key is recognizing those mistakes, understanding the underlying emotional drivers, and developing strategies to avoid repeating them.

The book's strength lies in its simplicity. Richards avoids jargon and complicated formulas, opting instead for clear, concise language and charmingly simple illustrations that perfectly encapsulate the core message. These visuals aren't just decorative; they serve as powerful reminders of our behavioral biases and the importance of mindful decision-making. The "behavior gap," the distance between what we should do and what we actually do, is vividly brought to life, making the concept relatable and easily understood.

Beyond the compelling narrative and engaging style, the advice offered is both practical and insightful. Richards effectively connects financial planning with our personal values and life goals, emphasizing that investing is not just about maximizing returns but about aligning our financial decisions with our overall life aspirations. He encourages a holistic approach, urging readers to consider their time, energy, and emotional well-being alongside their financial resources. This emphasis on a personalized approach, rather than a one-size-fits-all strategy, is refreshing and makes the advice even more impactful.

While the book doesn't provide specific investment strategies (it’s not a "how-to" manual), it equips readers with the crucial self-awareness necessary to make better financial choices. By understanding the emotional landscape of investing, we can begin to navigate the financial world with greater clarity, confidence, and ultimately, success. "The Behavior Gap" is a valuable resource for anyone, regardless of their financial experience, who wants to take control of their financial future by first understanding themselves. It's a book I'd wholeheartedly recommend to both novice investors and seasoned professionals alike. It's a reminder that the most significant investment we can make is in ourselves and our understanding of our own behavior.

Information

- Dimensions: 5.5 x 0.44 x 8.25 inches

- Language: English

- Print length: 192

- Publication date: 2024

Preview Book